How to See Which Google Ads Your Competitors Are Running

There comes a time in every marketer's life when you start to question things. You realize you've spent your career to this point largely within your own bubble. You know, more or less, what you want to be doing for your own brand. You know broadly what kinds of things your competitors are doing, but you don't spend a lot of time examining them because you have your own house to keep in order.

Then you consider running ads, particularly Google Ads, and you pause. You realize that Google Ads are complex, tricky, and difficult to get running right and make a profit. Google is more than happy to let you experiment – they even give you free ads credit when you're first starting out – but they do so because they know the more time you spend flailing around, the more profit they can make from you.

You don't want to waste time or money, and you're clever. You know that your competitors are, in all likelihood, running their own Google ads. They probably have their wits about them and have found footing in the PPC space. So, it just makes sense. Look at what they're doing so you can copy it to get started for yourself.

The only question is, how can you do it? It's not like you can log into Google Ads and have them show you an entire list of all the ads currently running for a given keyword list.

The good news is that there are a few ways you can see what Google Ads your competitors are running at any given time. The bad news is that it isn't easy, comprehensive, or foolproof. So get ready to do some legwork and read on.

Limitations on Google Ads Competitive Research

Before we get started, let's talk about what you can't do.

Generally, this comes down to two things. A lot of Google Ads data is public – it's advertising, after all, it wouldn't do much good if it wasn't – but some of it isn't. This is especially true for the data on the back end.

#1: You can't see what search terms your competitors are targeting. You can get some idea of the search terms they're targeting based on what searches you do that bring up their ads. But you don't get to see their keyword list, their negative keywords, their matching types, or any of those other settings. Without having access to their Google Ads dashboard, all of this information is hidden from you.

#2: You can't see what your competitors are bidding for their ads. Bidding, both in terms of bidding strategies and in terms of the exact monetary values they're spending, is another piece of information no one outside of the brand themselves can see. Again, you can make some educated guesses based on the cost per action when you try to replicate their ads, but you won't be able to tell specifically what they bid or pay. It's also not entirely guaranteed to be accurate because of variables in targeting and even Ad Quality Score.

#3: You can't see the audience or other targeting factors for their ads. Another factor of ads that can make a huge difference is targeting. Geographic targeting, demographic targeting, and remarketing are the kinds of targeting details that are hidden from everyone but the brand. In fact, these can be a significant element of PPC that is completely hidden from you. You won't see ads aimed at people on your competitor's mailing list unless you're on that mailing list, right? It's hidden data.

Finally, pretty much any and all of these methods and all of this data are subject to variability and change. Google routinely finds ways to hide or crack down on competitive metrics, because they don't want people to be trying to game or spy the system, they just want you to try to run the best, most honest ads you can, and they'll decide what's relevant. If a method stops working, let me know, and I'll strike it from the list.

Tips for Scoping Out Competitor Google Ads

A lot of the work you do to check what your competitors are doing with Google Ads is just different ways of using one strategy: being the recipient of those ads.

To that end, obviously, the first thing you need to do is make sure you're browsing Google without an ad blocker. That means:

- Use a fresh browser installation/profile that doesn't have an ad blocker extension installed.

- Make sure you aren't using a DNS that filters ads like AdGuard DNS.

- Log out of any Google accounts you might be using to make sure your results aren't personalized.

You might also consider using a VPN or browsing from a public WiFi network. It's rare, but it's possible for someone to exclude an IP address from Google ads, and I've seen some people suggest excluding the IPs of known competitor business buildings, specifically so that they can't perform competitive analysis, and so they can't eat up your ads budget somehow.

Another tip, especially if you're using the plain old Google search method, is to do your research near the start of the month. I would say somewhere between the 5th and 15th of the month is ideal. If you do it too soon, you may be researching before your competitors have their PPC spooled up for the month. Conversely, if you wait too late, they may have burned through all of their budget already. Now, that still can be relevant information – and seeing exactly when in a month your competitors drop out can be valuable information – but that's for second-order research, not primary research.

Finally, don't get too muddled in the details. Different brands can have different emphases in the industry, and your competitors may be running ads for keywords that wouldn't benefit you to compete. Similarly, there are going to be a ton of big brands like Amazon running ads for things you would love to compete with, but there's pretty much no way you're going to out-spend Amazon. You can often write data like this off as not useful and move on.

How to View Competitor Google Ads

Now, let's get started with how to actually scope out competitor ads.

The first thing you need to do is some keyword research. It doesn't have to be deep, detailed, or even really useful keyword research. All you need to do is use a competitive research tool and process like I've outlined in this post to find the top-ranking keywords your competitors are using. At the same time, look for industry, topic, and product-related keywords. Even something as simple as your competitor's brand name can be a valid keyword here. Your goal is to build a list of keywords that are things your competitors are probably targeting since you can't find their actual keyword lists.

Then, go to Google and start trying those keywords. Look at the sponsored results, look for what companies are showing up in those results, and if the competitors you're looking for are there, scrape whatever information you like about them.

Note: Just because your competitor doesn't show up doesn't mean they aren't targeting that keyword. It just means that if they are, they aren't bidding enough to show up in the top spaces. Sometimes, you can scroll further and find more ads and find them, and other times, they just won't show up. Fortunately, if they aren't showing up, it's not terribly relevant information either way.

That's the first, easiest, and by far the most tedious, slipshod, and inconsistent way to get this data. It works, and it's free, which is why it's the first one I mentioned, but it's only going to give you a fraction of the total picture.

You can, of course, augment this information in other ways. For example:

- Use the Google Ads impression share metric. Run your own ads for the keywords where your competitors are operating, even if you don't out-bid them. By looking at your impression share, you can estimate theirs based on the search results.

- Use the Google Ads keyword planner. This tool gives you the ability to discover new keyword suggestions. When you put in a primary keyword, it will show you secondary keywords. Critically, they also give you pricing information for the bidding range. This can help you estimate how much money your competitors are spending on those ads.

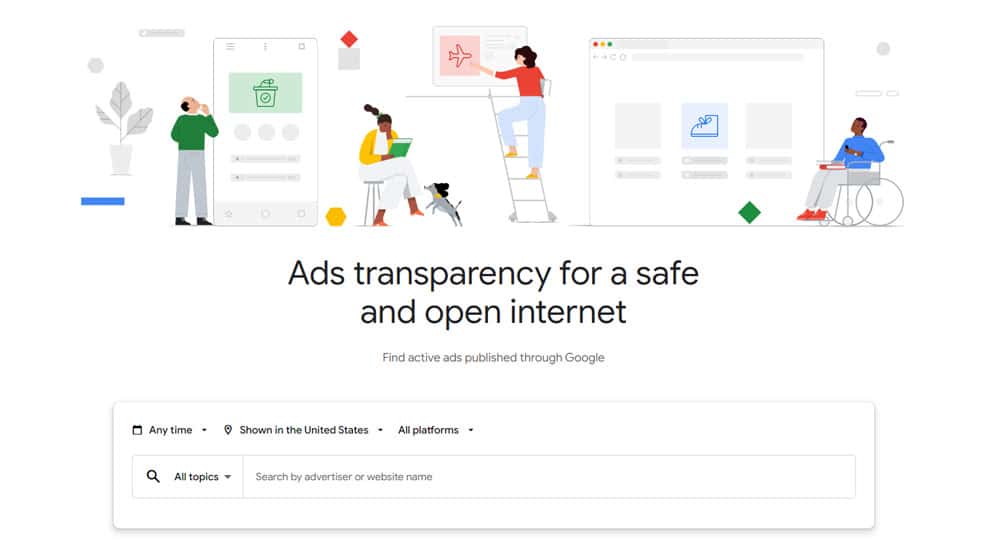

Another Google resource you can use is the Google Ads Transparency Center. The Ads Transparency Center allows you to search by business name and see the ads being run by that business. For example, if you plug in HubSpot, you can see that they're (as of this writing) running around 5,000 different ads. You can filter by time, location, and format and see previews of the ads.

The Transparency Center is also good because if a brand has multiple sub-brands all running ads, Google is smart enough to lump them together. And, you can click on an ad to see any ad variations it may have, so you can get an idea for what kind of split-testing your competitors are doing.

The biggest drawbacks to this method are the lack of sorting, filtering, and analysis. All you can see is the ad copy and the fact that the ads exist or if a brand you know of isn't running ads. You don't get any information on the targeting or performance of the ads other than what the ad copy reveals about them.

Of course, getting your information from Google isn't the only option.

Using Apps for Google Ad Research

Now, there have to be some tools that can help you out, right?

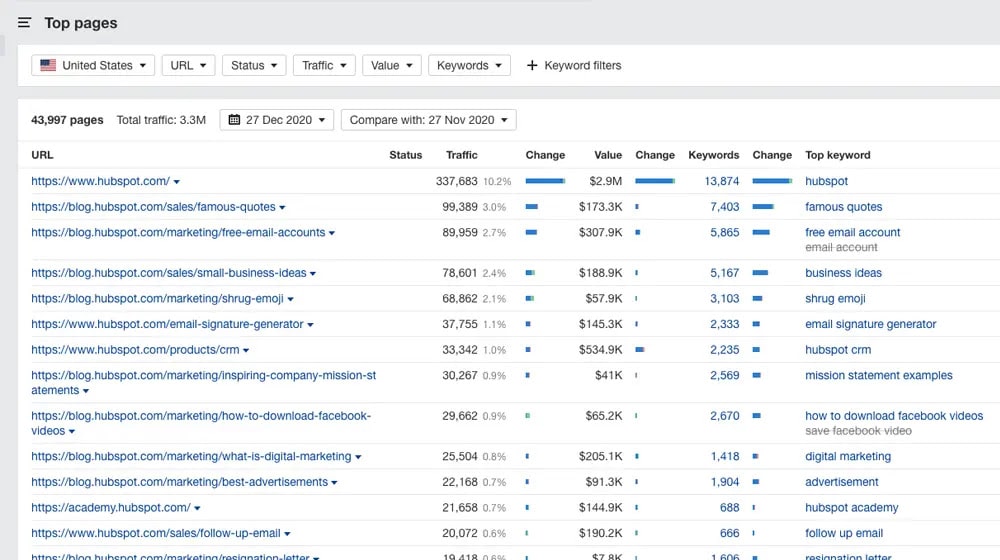

Ahrefs is my go-to. When you use Ahrefs Site Explorer on a competitor domain, you will have the option to see their paid keywords. This shows you a report of the keywords, whether or not there are active ads (and what those ads use as ad copy), the search volume, difficulty, traffic, and landing page URL, among other data for those ads. Ahrefs can also give you historical data as well.

Ahrefs can also just show you the ads being run by a competitor domain or for a given keyword. You can see the title, URL, text, and other information for the ad. Ahrefs can only estimate certain metrics like traffic, of course, but they can give you reports on whether they've seen the same ad across multiple keywords and other handy information.

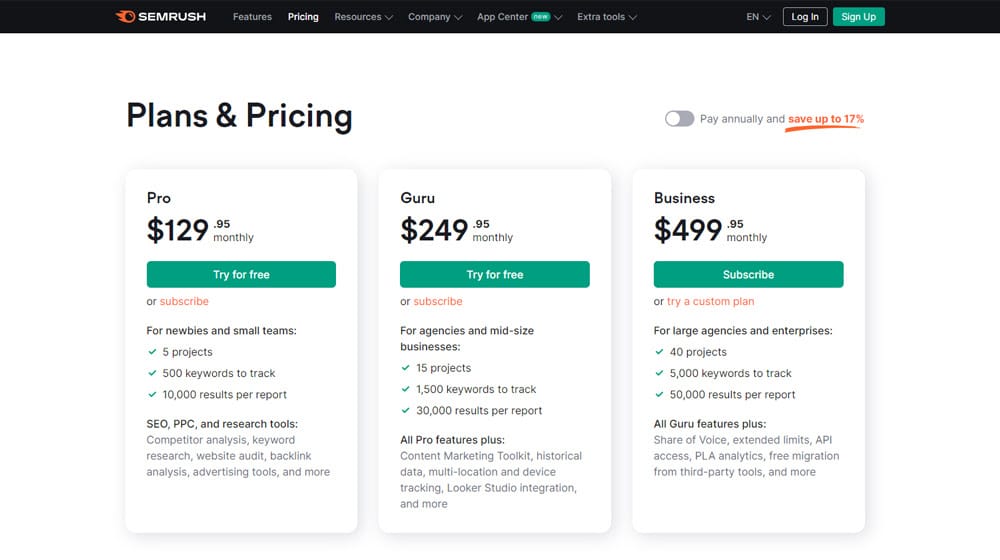

Another good option is Semrush. Semrush gives you an Advertising Research report, which can show you ads for a domain, including the ad positions, positional changes, any competitors for that ad slot, the copy for the ads, and even a history of the ads for that domain. Fortunately, you don't need anything more than the basic plan to access PPC data.

A third option is to use SpyFu. I usually find SpyFu to be a little less useful than something like Semrush or Ahrefs, but in this case, SpyFu was the one to start up PPC research first, and it's their core focus, so their data is honestly pretty good.

Whenever you're using a non-Google source for data like this, though, make sure you're getting that data from different sources if you can. Obviously, it's really expensive to use Ahrefs, Semrush, and SpyFu all at once, though if you already use the tools for other reasons, it's not that bad. But comparing data from different sources allows you to get a more robust picture of what's going on.

Do you have any suggestions or other tools you've used to successfully scope out your competitor Google Ads? I find that there are surprisingly few good ways to do it because so much of the data either comes from Google themselves (which they don't want to give up) or from companies with massive search indexes, which are few and far between. So, if there's an option you know of that I didn't mention, feel free to let me know in the comments below.

Comments