What is IR (Investor Relations) Marketing and How Does It Work?

Most of the time, when you think of marketing, you're talking about a business marketing itself toward consumers. If you're more immersed in the business world, you might also be aware of B2B marketing, where a business or service provider (like me!) markets itself toward other businesses. B2B and B2C marketing make up the bulk of marketing efforts, but they aren't the only kinds of marketing out there.

Another form of marketing your business might look into is investor relations.

This is something that I hear about all the time on client calls when discussing content strategy, whether working with startups or larger companies.

What is it, though, and how does it work? Read on to learn more.

30 Second Summary

30 Second Summary

You need to market differently when targeting investors versus customers. You'll want to focus on telling a consistent brand story and showing how your business can grow with funding. You have to share financial data, growth trends and future plans with the right channels where investors look for opportunities. While you don't need investor relations marketing to succeed, it helps if you want to scale quickly or sell your business. Before starting, you should research potential investors who match your industry and be ready to demonstrate how partnering would benefit both parties.

What is Investor Relations Marketing?

In a sense, you could consider investor relations marketing a "B2I" marketing strategy (business to investor).

It's a lot like B2B and a lot like B2C; you're targeting specific groups of people. Rather than that group being "people who may be interested in buying your product," it's "people who may be interested in funding your business." This strategy is popular among both startups and large public companies alike.

The reality is that it's challenging to get a business up and running in today's economic climate.

When any uncertainty, unexpected expense, or matter of scale can tip the calculations into the red, a business owner can quickly be left in a position of either going into massive debt or letting their business die.

Unfortunately, one of the most common causes of this is a business success! If you're operating a business and trucking along just fine, but something in the universe lines up just right, and your company suddenly goes viral, you might have 2x, 3x, 5x, or 10x the number of potential customers knocking at your door. You aren't prepared for that scale, don't have the funds to invest in producing more products or scaling up your infrastructure, and have to implement things like waiting lists. By the time you get everything sorted out, interest has faded, and you've failed to take advantage of the situation. It can feel like a massive failure, even if you're better off than where you started.

The prospect is the same whether it's an angel investor or "shark" like Mark Cuban, Kevin Rose, Mark Andreessen, or others, or a venture capital firm like Sequoia Capital, Accel, or others.

You have an outside entity that has resources for you. These resources can be raw monetary funds but can also include established marketing channels, connections with retailers or marketing firms, partnerships with other brands that could augment your own, and more.

Of course, nothing in life is free, and investment from angels or venture firms comes with a cost.

Usually, that cost is some percentage of controlling interest in your company. They might become 10% or 15%, or 30% stakeholders in your business; your success feeds back into them, and their goal is to more than repay their initial investment in your company. Sometimes it works; sometimes, it doesn't. Sometimes you succeed enough that they buy you out; other times, they sell out of your business entirely.

Investor Relations Marketing is marketing, but the people you're trying to reach are the angel investors, venture firms, and those who make these decisions.

Is Investor Relations Marketing Unique?

Sort of!

Investor relations requires specific knowledge of the audience you're targeting with your marketing. It also requires specific kinds of marketing. Investors aren't reading your basic blog posts about the tertiary problems in your industry. Instead, they're more interested in a direct, up-front discussion of the problem your company identified and addressed with your product, the challenges, the ways you're striving to overcome them, and more.

You know the basic concept if you've seen Shark Tank or Dragon's Den (the U.K. equivalent).

That pitch, Q&A session, and deal-making are part of Investor Relations Marketing. The most significant difference is that, unlike the more scripted, cherry-picked, short-lived meetings you see on TV, real investor relations can take much longer, be a slower process, and be more passive.

What Goes into Investor Relations Marketing?

Investor relations marketing is specific marketing aimed at a particular person. That means, as with all marketing forms, you must carefully consider the channels and messaging you use.

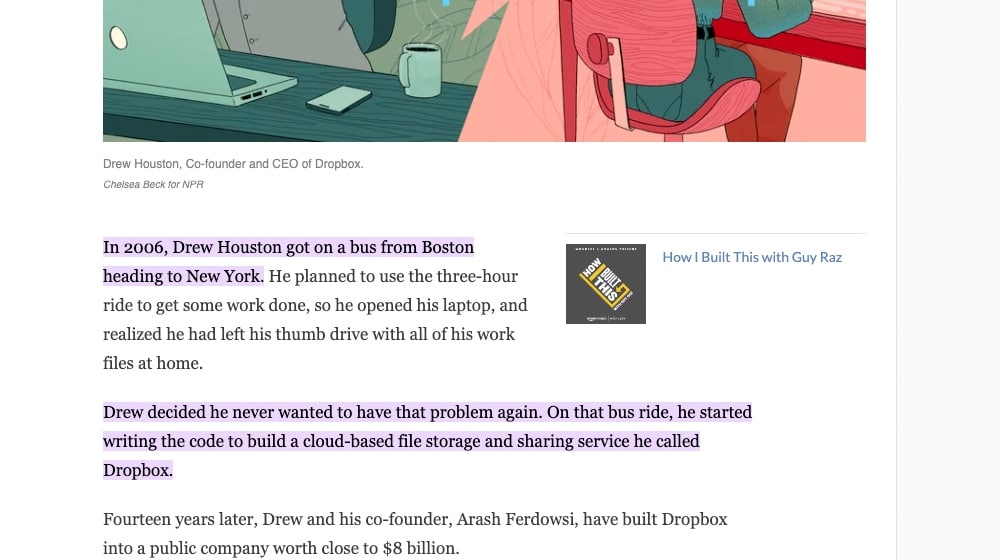

1. Storytelling

Investor relations marketing requires uniform and compelling storytelling. Modern investors recognize that a brand can't just come to market with a product, point at it, and say, "you either buy it or you don't."

Consumers are vastly more interested in brands they can have some connection to, whether it's because of the environmental protection your brand funds, the investment community initiatives you participate in, or just the narrative you convey in your brand backstory.

At the same time, investors know that if there are faults in your brand – inconsistencies in the story, differences between what you say and what you do, or just a poor and uncompelling pitch – someone else can come along and create a competing product with a more unified brand and out-do you.

So, a crucial part of investor relations marketing is identifying your brand story and promoting it in a unified fashion between all different aspects of your marketing.

Inconsistencies can and will be caught out and will torpedo your chances.

2. A Presence on The Right Channels

Another core aspect of investor relations marketing is producing content for the specific channels and pipelines investors use to look for new opportunities. With traditional B2B and B2C marketing, you're posting on your blog, and you're posting on social media, you're promoting yourself with paid ads, and so on.

With investor relations marketing, the channels are different. You may be creating media releases and press releases. You may announce, host, or sponsor events. You might produce videos targeted not at the usual consumer but at potential investors. A news feed is also usually welcome, even if your financial reports and posts about your investment decisions differ from the content you produce for an average business blog. Many large-scale businesses maintain both a for-users blog and a for-investors news blog.

You might also find and participate in media channels where investors hang out; this can be events and public forums, private groups on Facebook and LinkedIn, or even specific social networks that revolve around investor relations. Publications and releases can go a long way as well.

While some investor relations marketing is direct communication with potential investors, a lot of it is producing content for the channels they browse and hoping to hit the right combination of interesting keywords and interest from investors at the right moment.

3. A Narrow Focus

One primary benefit of investor relations marketing over other marketing is that you often don't need to go broad. You can identify specific investors who could provide the required resources and target them with laser focus. It's the sort of long-shot-with-high-reward strategy that can pay off but still leave you in an excellent position to adapt if it doesn't.

Additionally, once you get your funding, you end up in a feedback loop. Companies with funding can leverage that funding for greater exposure, get free news coverage simply because they got funding, and grow using that funding. If further funding is necessary, it may come from a different source or from a partner; you can be more relaxed and proactive at seeking out the investors the second time around.

Do You Need Investor Relations Marketing?

Investor relations marketing is a powerful tool for promoting your business to get funding, but is it necessary? In many cases, no. Many business owners are in business because they want the personal satisfaction of growing their brand, and they want to avoid handing even partial control over their business to someone else. Of course, many of these people can be swayed by a sufficient number of zeroes on a check, but that's beside the point.

In many cases, investor relations require a mostly-new way of thinking and producing content for venues you may not be familiar with tapping. The initial investment has little-to-no guarantee of any viable success, and leaping at the first offer can be detrimental to long-term success; they aren't called "sharks" for no reason, after all!

There's also disruption to the whole industry. Crowd-funding platforms like Kickstarter, Indiegogo, and more business-focused platforms (like Fundable and EquityNet) are all potential alternatives.

Rather than having one angel investor or venture firm making investments (and demands), you have large-scale, broad funding from your potential audience. These platforms are better for certain kinds of businesses because they also serve as interest checks and preorder lists.

Not all businesses need investor relations. However:

- If your goal is to build a business, sell it, and use that funding to build another business and repeat the process, investors can be a huge boon.

- If your business has reached a stagnation point where more funding would push you over the line, but you can't swing it on your own, an angel investor can make a ton of difference.

Some brands are made for investment, while others would have trouble knowing what to do with it. It's something you need to evaluate for yourself.

Getting Started with Investor Relations Marketing

Unfortunately, you can't just take your traditional marketing team and tell them, "alright, produce content for investors now." While the core concept of marketing to a specific group of people is the same, in practice, it's completely different.

It can be details about your products.

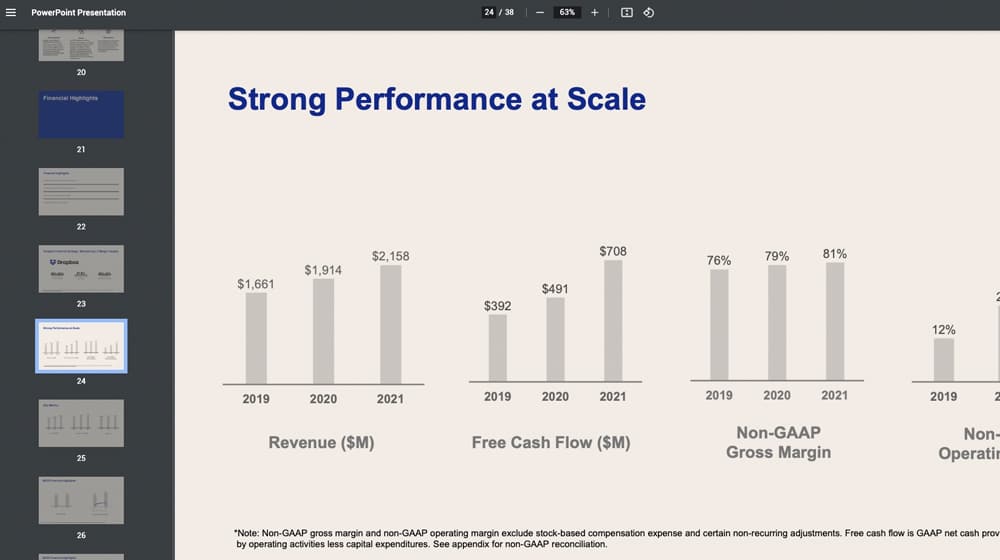

It can also be details about your financial situation and performance, sales numbers, potential future developments, growth trends, and predictions.

Think about your company from the perspective of an investor. What would they want to know to decide whether or not to invest in your brand?

You also want to do some research into potential investors. Make lists. Who – in terms of people and venture firms – are most likely to be interested in your business? After all, you don't want to market to an investor who has no interest in your entire industry. Look for people or firms who have worked with other brands in your industry or niche, who have good reputations and connections, and who might be able to help you partner up with others who can help you succeed.

Most importantly, remember that you aren't just focused on what they can do for you.

Focus on what you can do for them. Not personally, but in business.

Can your product interface with others on their roster and help increase the overall value of both? Can you provide a service that would be valuable to the rest of their portfolio? Above all, will you grow with their funding at a rate that pays back their investment?

Know what you're getting into.

This process is, of course, all just scratching the surface. Creating content that targets investors is a whole other industry and topic.

It might even be worthwhile to hire an investor relations professional to work with you, building an IR team, creating content, and making connections. If you're ready to take that plunge, it's a viable option.

Investor relations marketing isn't for everyone, but if it's right for you, it can make all the difference in the world.

Do you have any questions for me about IR marketing? Are you considering an investor relations marketing strategy for your business? Please let me know in the comments below! I'd be happy to answer any questions you might have and start a conversation on the subject.

30 Second Summary

30 Second Summary

Comments